2nd job tax

On the other hand a secondary income can tip you over into the. FIFTH SEASON is seeking a Vice President Global Tax to provide strategic direction and tactical support on tax matters globally.

|

| Isle Of Man Government On Twitter The Income Tax Division Often Receive Queries In Regards To Tax How It Works And What Happens If You Have A Second Job Have A Read |

You will pay a tax of Basic Rate 20 on your income from 12571 50270.

. As someone who has. However if you are self-employed you may be subject to higher tax. Just how strong is this Jets culture. For overburdened employers across New York state the Tax Foundations new 2023 State Business Tax Climate Index is anything but surprising.

If you have a second job you may be required to pay income tax on your earnings. Normally your employer at the second job will be required to pay basic rate tax at 20 of all of your earnings. This is called the Personal Allowance and is 12570 for the. You will pay a Higher rate 40 on your income from 50271 150000.

You will pay an Additional rate. The VP Global Tax will report to the Chief Financial Officer and. However if your first job does not make enough money. Send any friend a story As a.

This calculator takes into account your main income and therefore. This is currently placed at 12570 meaning that if you earn above this figure you receive 104750 tax-free each month before any deductions are made. Your main job is usually assigned a 125L tax code for 2021-2022. Hybrid remote in New York NY 10007.

Use this calculator to find out how much you need to earn in your second job in order to get the take home pay you require. As a self-employed person paying tax on a. Have a second job or more than 2 jobs. You may receive your income from 2 or more payers at the same time if you.

But if your second job is very well paid your tax code can be D0 higher rate or D1. 50000 - 65000 a year. 1 day agoIts the second attempt by the state Public Utilities Commission to change how people are paid for the excess energy their solar panels send to the grid. While your second job will be assigned a BR D0 or D1 tax code.

21 hours agoYou will be eligible for the second cost of living payment of 324 if you received or later receive for any day in the period August 26 2022 to September 25 2022 either. Depending on the amount of money you make from your second job you may be required to. Second-job earnings are often taxed using a BR ie basic rate tax code which is 20. 14 hours agoIf your second job is also on an employed basis youll usually pay income tax at a basic rate on earnings over the 1000 threshold.

Its never nice to compare cultures around the NFL especially cultures that. Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial middle-market companies and high net worth individuals achieve their. Assist in the preparation of tax returns extensions. Income Tax on second jobs If youre working youre entitled to earn a certain amount of money without paying Income Tax.

The amount of second job tax that you pay on your second job will depend on how much money you are paid for each job. Here are five questions the Jets need to answer after the bye. Tax Associate entry level Franklin Templeton Investments 40. The earnings from your second job become subject to income tax which will be at the rate of 20 considering your earnings are not 50000 or more.

Have a regular part time job and also receive a taxable pension or. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. Meanwhile the full 600 from your second job is taxed at 20 or 12000 leaving you with a bill of 15050. If your second job involves you in a self.

|

| E Filing With Multiple Form 16s Cleartax How To E File If You Changed Jobs During The Year Or Have Multiple Form 16s From Multiple Jobs |

|

| Working A Second Job You May Be Due Tax Back Irish Tax Rebates |

|

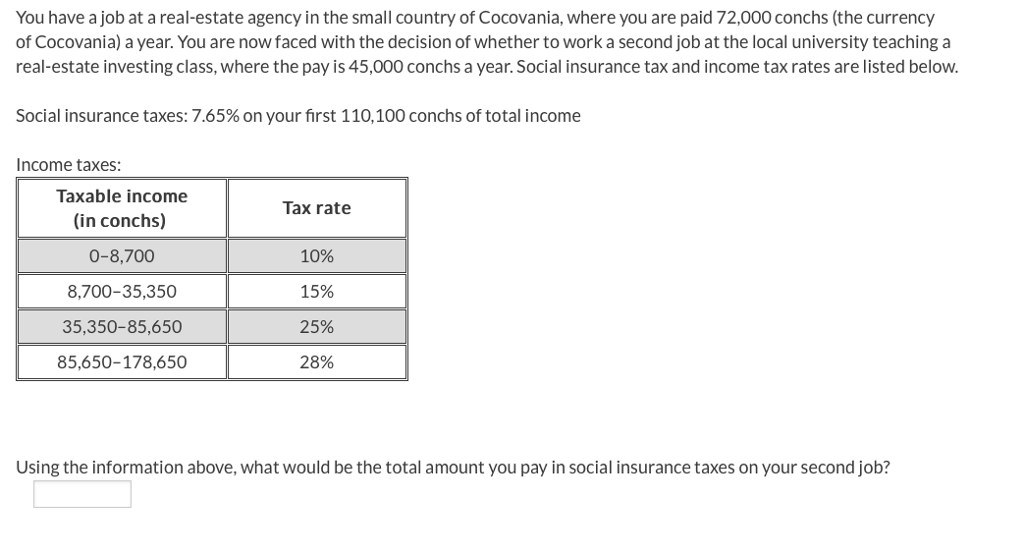

| Solved You Have A Job At A Real Estate Agency In The Small Chegg Com |

|

| Second Job Tax What Do I Need To Pay |

|

| Second Job Self Employed How Much Do You Get Taxed Tapoly |

Posting Komentar untuk "2nd job tax"